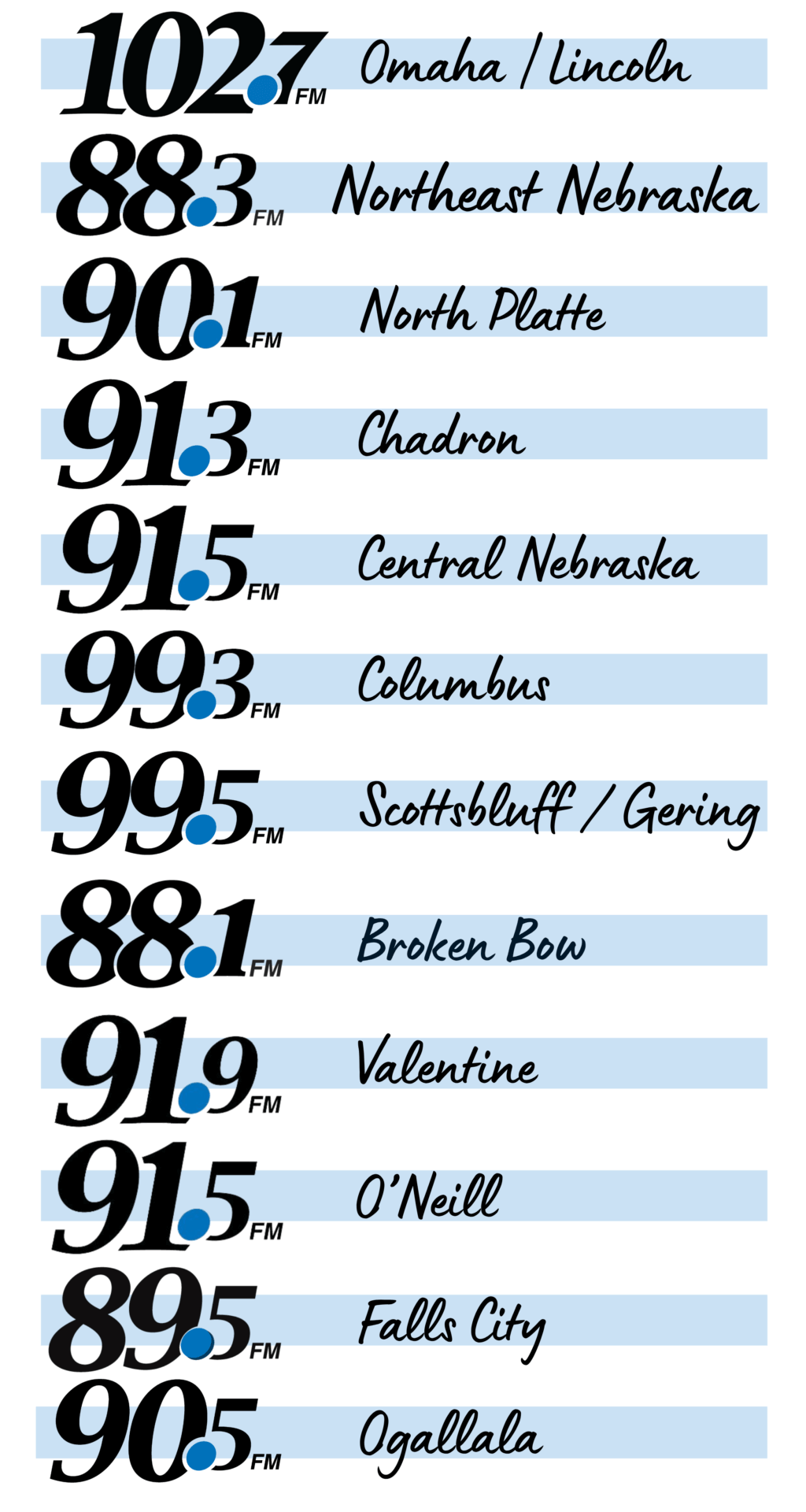

As a part of the Spirit Heritage Society, your legacy gift supports the future of the Spirit Catholic Radio Network. By participating in the planned giving process, you can be assured that when you leave this earth your charitable gift will continue to support this apostolate and its mission of bringing Christ to people and people to Christ throughout the listening area.

As a part of the Spirit Heritage Society, your legacy gift supports the future of the Spirit Catholic Radio Network. By participating in the planned giving process, you can be assured that when you leave this earth your charitable gift will continue to support this apostolate and its mission of bringing Christ to people and people to Christ throughout the listening area.

What is the Spirit Heritage Society?

The Spirit Heritage Society recognizes those individuals whose planned gifts provide long-term financial security to Spirit Catholic Radio. These gifts will also help pay operating expenses as well as help with expansion efforts. By making a charitable gift of estate assets to a non-profit organization like Spirit Catholic Radio, you are participating in planned giving.

Sometimes called charitable gift planning, the process involves a gift that requires consideration and planning in light of your overall estate plan. Because of the size and potential impact of such gifts, you should consult with a qualified professional adviser before completing the process. We make it easy to contribute to the future of Spirit Catholic Radio by offering many gift options. If you are interested in requesting additional information or are ready to begin the process, simply fill out or download the enrollment form via the button below or contact Bernie or Wayne with your questions.

Bequests from Your Will

Bequests from Your Will

The most common approach to making a planned gift is a bequest or gift from your will. You can name a specific amount, a percentage of your estate or the remainder of your estate.

Benefits to You:

- The ability to control and pass on the assets that you worked hard to accumulate.

- Reduce or eliminate federal estate taxes.

- Offers flexibility to customize your planned gift as you wish.

CREATE YOUR WILL — FOR FREE!

Your legacy of faith builds with each passing day, and we want to help you secure it effortlessly! August is Make-A-Will Month, a perfect time to take action and secure your legacy. Spirit Catholic Radio has partnered with My Catholic Will – the only online Catholic will-writing tool available. This partnership allows you to secure your legacy of faith and give hope to future generations of Catholics in the most meaningful way.

Writing your will on My Catholic Will is simple and stress-free. In as little as 15 minutes, and without any complicated documentation, you can write your will and consider an optional legacy gift to Spirit Catholic Radio. The best part is that it is completely FREE to use.

To write your will FREE of charge, please click below to get started and take the first step toward preserving your legacy!

Gift Annuities

A charitable gift annuity is an agreement between the charity and the donor(s). In exchange for the donor’s irrevocable gift, the charity agrees to pay one or two specified individuals (annuitants) an annual sum (annuity) for his or her lifetime. With a gift annuity to the Spirit Catholic Radio Heritage Society, you can give a charitable gift now, and receive income for life.

Benefits to You:

- Receive guaranteed annual income payments for your life, not for a number of years. Part of this income is tax-free.

- Receive a higher rate of interest than you would normally receive on a CD or stock dividend. Annual rates range from 5% to 11%.

- Receive a charitable income tax deduction.

Life Insurance

You can become part of the Spirit Heritage Society by making Spirit Catholic Radio a beneficiary of a life insurance policy.

Benefits to You:

- By giving a gift of a policy that is no longer needed, you can reduce the size of your estate.

- If donating a new policy, you can take the annual premiums as a tax deduction.

- Spirit Catholic Radio may also be named as the owner and beneficiary of an existing policy.

Remainder Trusts

Remainder Trusts

A charitable trust provides income payments to you or family members. It can run for your lifetime or for a number of years. Sell a highly appreciated asset tax-free within the trust, reinvest it and receive a higher rate of annual income. You can choose to be the trustee and continue to manage your assets, or appoint one.

Benefits to You:

Bypass any capital gains tax on a highly appreciated asset.

Increase income from a low- or non-income producing asset (e.g., CD, stock).

Receive a charitable deduction for a portion of the value of the asset you contributed.

IRA and 401(k) Plans

Your IRA has deferred income taxes due after your death. If you also have estate taxes due, your IRA assets could be reduced by more than 80%, leaving little to your family. Make the Spirit Heritage Society a beneficiary and choose other assets to leave your family.

Benefits to You:

- A simple way to name Spirit Catholic Radio as a beneficiary of your plan without changing your will.

- Saves your estate a large portion of possible taxes.

- Allows you to take advantage of federal incentive programs such as the Pension Protection Act that allows you to withdraw IRA amounts up to $100,000 tax-free.

Spirit Catholic Radio Foundation

One of the steps we as a radio network recently made that will impact the future of Catholic radio is the launch of our Spirit Catholic Radio Foundation. In partnership with the Catholic Futures Foundation and the Catholic Foundation of Southern Nebraska, dedicated funds can now be distributed into an account that will be used to sustain Spirit Catholic Radio well into the future. The Spirit Catholic Radio Foundation is a board-directed account that will allow us to utilize resources to update tower equipment, seed the future growth of new stations, launch exciting new Catholic programming and assist in consultation with other Catholic radio networks across the country. Over the last 30 years, Catholic radio has been a growing icon of evangelization around the world. Spirit Catholic Radio continues to be an industry leader among the hundreds of Catholic radio stations in the United States alone. Your long-term support of our efforts, through a gift to the Spirit Catholic Radio Foundation, will ensure that Catholic radio continues to flourish and grow for the generations to come.

Questions?

|

Bernie Schaefer | Vice-President of Development |855-571-0200 | [email protected] |

|

Wayne Crome |Lincoln & Regional Development Director |855-571-0200 | [email protected] |